“This can definitely be a movement,” he says. In this case, someone with papers hands lacks the appropriate conviction in a trade.) He purchased two more shares at over $300-most of what he earns in his paycheck from a home-loan refinance firm-and still has them. (“I paper-hands’ed it,” he says, using some of the coded language WallStreetBets enjoys. He bought his first share of GameStop for around $80, selling it at $94.

“I think it's very important to highlight and showcase what's going on and how blatant it is.” Aganis hasn’t had a lot of capital to put toward the goal. “There’s inherent corruption within our financial system in the U.S.,” he says. Trevor Aganis, a 22-year-old in Kansas, couldn’t agree with Gainer more. “I'm not in it to cost anybody their lives, but like, You gotta sell a couple boats? I’ve got no problem with that.” F-k them.” He continues to wait on a position once worth over $100,000, hoping the shares will rise again in price, renewing pressure on short-selling financial institutions. Burn it all down,” says Justin Gainer, 30, of Chicago. They hope it draws the attention of authorities willing to mete out immediate punishment and think out long-term reforms to reduce the advantage institutions have over ordinary investors. They see their continued investment as a perpetual indictment of Wall Street, driven by fury over brokerages such as Robinhood and Interactive Brokers limiting their ability to trade GameStop. It’s just one part of my portfolio.”īut the prevailing attitude on WallStreetBets is rooted in something more philosophical. In a somewhat similar place is Ramon Figueroa, a 39-year-old physicist in Dallas: “My personal situation is not gonna break my finances.” When his GameStop shares decreased in value by $220,000 in a day, he took a screenshot of his brokerage account and posted it to WallStreetBets, contributing to specific subgenre of catharitic content there known as “loss porn.” “I am not losing my house or anything over in that trade. And I wouldn’t ever put more than just like a little bit amount into these kinds of stocks,” he says. “I don't have that much money lying around. In his case, his stash of GameStop securities have fallen in value from $1,200 last week to $500 today.

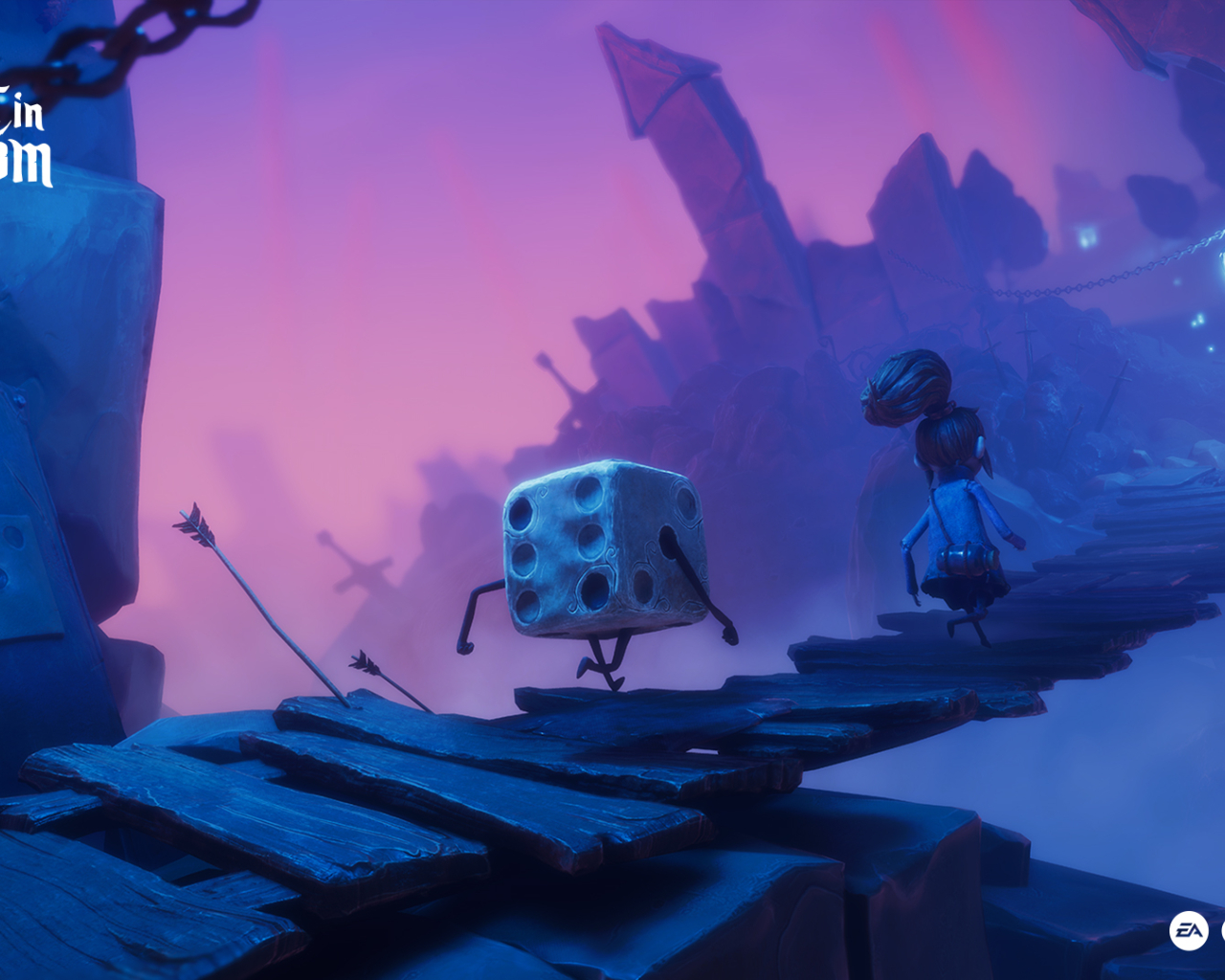

LOST IN RANDOM GAMESTOP SOFTWARE

Others are more like John Simerlink, a 24-year-old software engineer in Columbus, Ohio: They didn’t gamble very much to begin with and aren’t at all enveloped by the idea of some great squandered treasure. “I would never put as much money on the line as I did if I didn't go in and thinking, ‘Okay, this makes sense,’” he says. (A sign of an immensely undervalued stock-or a stock not worth owning at all depending on perspective.) Thomas was further buoyed by a recent investment in the company by Ryan Cohen, founder of, the pets e-retailer sold to Amazon for $3.35 billion in 2017 he saw Cohen’s presence as a validation of the company’s attempt to establish a foothold on the web. In his study, he centered on the company’s newfound determination to replace brick-and-mortar stores with an online presence, as well as the shares initially trading for less than 1 times sales. Seth Thomas attributes the view to hours spent researching the business. The Thomases in Maryland belong to a singular set among the Redditors in their brow-furrowed belief that GameStop represents a valuable long-term investment.

But in the latest unexpected chapter of the GameStop saga, the majority of the Redditors are upbeat, many declaring an absolute dedication to holding onto the company’s shares, consequences be damned, the opposite reaction you’d expect from investors recently whipsawed through a financial mania.

0 kommentar(er)

0 kommentar(er)